German aluminium industry struggles continue

The German aluminium industry has endured a fourth consecutive year of economic strain in 2025, with production levels far below pre-crisis figures and weak demand from key sectors dragging on recovery, industry figures show.

According to the annual industry report released Tuesday by the trade association Aluminium Deutschland, production capacity utilisation continued to decline last year, remaining between 76 % and 88 % of the levels seen before the crisis began in 2021. The association highlighted a lack of growth since that year and broadly under-utilised facilities across the sector.

Mixed Performance Across Product Segments

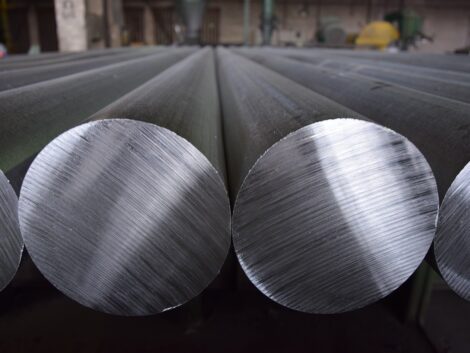

The performance of different product groups was uneven in 2025. The production of recycled aluminium fell by about 1 %, to around 2.7 million tonnes – roughly 16 % below 2021 levels. Similarly, output of extrusion products such as rods, profiles and tubes declined by about 1 % to 463,000 tonnes, lagging roughly 24 % behind pre-crisis production.

By contrast, output of rolled aluminium products – used in car bodies, building facades and beverage cans – rose by roughly 2 % to about 1.8 million tonnes. Even so, production of these goods in 2025 was still roughly 12 % below 2021 levels.

Weak Demand, Rising Costs

Industry leaders point to subdued demand from crucial customer sectors such as automotive, construction and plant engineering as a central factor in the persistent downturn. A shortage of scrap aluminium and steep price increases for raw materials have also weakened the recycling segment’s performance.

The association blamed broader structural and economic conditions for hampering the sector, including high energy costs and what it described as inadequate policy support. Trade measures such as the European Union’s carbon border adjustment mechanism (CBAM) were cited as further undermining the competitiveness of German producers on global markets.

Revenue Holds Steady Despite Output Dip

Despite declining production in several areas, total industry turnover remained stable in 2025 at around €22.8 billion, buoyed by higher aluminium prices on international markets, according to the association.

The German aluminium sector comprises some 237 companies, collectively employing about 55,800 people.

Industry representatives warned that without stronger policy support and improvements to Germany’s industrial framework, the sector faces ongoing competitive pressures and risks to its resilience and future investment climate.