Novelis reports Q3 results

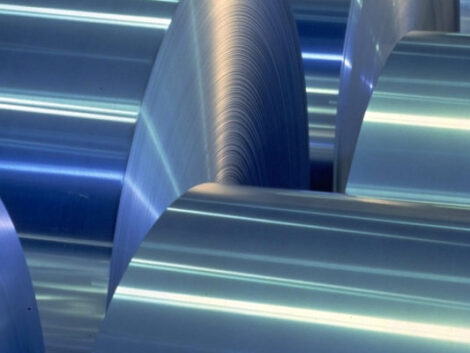

Novelis Inc., a leading sustainable aluminium solutions provider and the world leader in aluminium rolling and recycling, has reported results for the third quarter of fiscal year 2023.

Net income attributable to its common shareholder decreased 95% versus the prior year to $12 million, due mainly to factors driving lower Adjusted EBITDA and unfavourable metal price lag from falling aluminium local market premiums in the current year.

Excluding special items in both years, third quarter fiscal year 2023 net income from continuing operations decreased 60% versus the prior year to $96 million due primarily to lower Adjusted EBITDA.

“As expected, our results were pressured by continued unprecedented inflationary headwinds, but were also further impacted by lower shipments resulting from significantly larger than anticipated customer inventory reduction actions in the beverage packaging market,” said Steve Fisher, President and CEO, Novelis Inc.

“We will continue to address these short-term challenges while remaining focused on building for our future in a prudent manner. Importantly, we believe the underlying demand fundamentals driven by increasing consumer preferences for lightweight, sustainable aluminium solutions in all our key end markets remains unchanged.”

Net sales decreased 3% to $4.2 billion for the third quarter of fiscal year 2023, compared to $4.3 billion in the prior year period, primarily driven by lower average aluminium prices and a 2% decrease in total flat rolled product shipments to 908 kilotonnes, partially offset by increased product pricing and favourable product mix.

The decrease in shipments is mainly due to lower beverage can shipments as customers reduce their inventory and adjust to more normalised levels of can demand post-pandemic, and softer demand for specialties products in this weaker macro-economic environment.

Conversely, easing supply chain constraints, including higher semiconductor availability, resulted in higher automotive shipments compared to the prior year.

Adjusted EBITDA decreased 33% to $341 million in the third quarter of fiscal year 2023, compared to $506 million in the prior year period, driven by an extraordinary inflationary environment and higher energy costs due to geopolitical instability.

Results were also impacted by less favourable metal benefits from recycling, unfavourable foreign exchange, and lower volume. These headwinds were partially offset by higher product pricing, including some higher cost pass-through to customers, and favourable product mix.