Alcoa sells Rolling Mill to Kaiser Aluminum

Alcoa Corporation has announced an agreement to sell its rolling mill business, held by Alcoa Warrick LLC, to Kaiser Aluminum Corporation for total consideration of approximately $670 million, which includes $587 million in cash and the assumption of $83 million in other post retirement employee benefit (OPEB) liabilities.

The sale is expected to close by the end of the first quarter of 2021, pending regulatory approval and customary closing conditions.

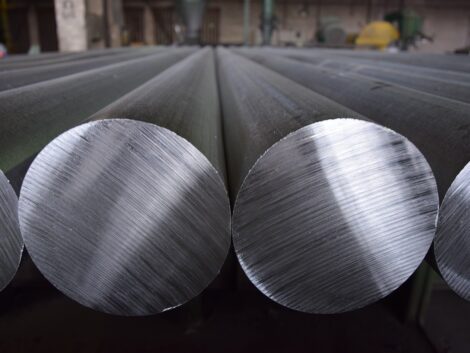

The rolling mill is located at Warrick Operations, an integrated aluminum manufacturing site near Evansville, Indiana. Alcoa will retain ownership of the site’s 269,000 metric ton per year aluminum smelter and its electric generating units. Alcoa will also enter into a ground lease agreement with Kaiser for property that Alcoa will continue to own at the Warrick site.

Today’s announcement is part of Alcoa’s strategy to generate between $500 million and $1 billion in cash through the sale of non-core assets and will put total cash proceeds in the target range. Earlier this year, Alcoa announced the sale of its former waste treatment business in Gum Springs, Arkansas, and received $200 million in cash with an additional $50 million that will be paid if certain post-closing conditions are satisfied.

“The sale will achieve a key target in our strategy to focus on core markets while generating additional cash,” said Alcoa President and CEO Roy Harvey. “We look forward to having Kaiser Aluminum as a valued customer at Warrick Operations, and we thank all of the employees who have contributed significantly to the site’s 60-year history of manufacturing excellence.”

As part of the transaction, Alcoa will enter into a market-based metal supply agreement with Kaiser Aluminum at closing. Alcoa will continue to operate the smelter and the power plant, which together employ approximately 660 people.

Approximately 1,170 employees at the rolling operations, which includes the casthouse, hot mill, cold mills, and coating and slitting lines, will become employees of Kaiser Aluminum once the transaction is complete. The rolling mill produces approximately 310,000 metric tons of flat rolled aluminum annually for use in packaging, including food containers, aluminum cans, and bottles.

After closing, Alcoa expects annual approximate decreases in sales of $800 million, net income (pre- and after-tax) of $45 million to $55 million, and Adjusted EBITDA of $90 million to $100 million, based on last 12-month pricing through September 2020. Alcoa expects to spend approximately $100 million for site separation and transaction costs, with approximately half being spent in 2021 and the remainder in 2022 and 2023.