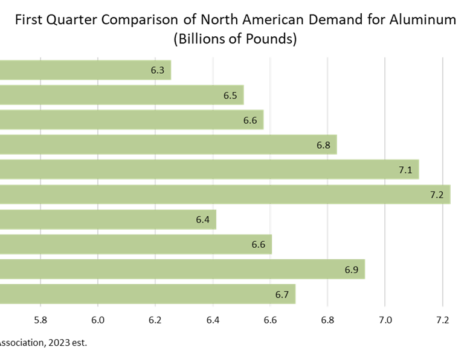

Domestic aluminium demand dips 3.5% in Q1

The Aluminum Association released preliminary estimates as part of its monthly Aluminium Situation statistical report showing demand for the aluminium industry in North America (U.S. and Canada) declining 3.5% through the first quarter of 2023. This follows estimated 4.8% demand growth through the end of 2022 and comes during a period of significant investment by U.S. aluminium producers, fabricators and recyclers.

“The picture for the U.S. aluminium industry remains very strong,” said Charles Johnson, president & CEO of the Aluminum Association. “Looking ahead, demand for recyclable and sustainable materials, ongoing infrastructure investment and robust trade enforcement are all making America a very attractive place to make aluminium – as evidenced by the fastest pace of investment for the industry in decades.”

Since 2021, Aluminum Association member companies have announced nearly $6 billion in domestic manufacturing operations ($9 billion over the last decade) – including new, U.S.-based greenfield facilities for the first time since the 1980s. And a recent automaker survey by consultancy Ducker Carlisle showed that aluminium use will grow by around ~100 pounds per vehicle from 2020 to 2030 as electric vehicles continue to penetrate the market.

Among key takeaways from the report:

- Aluminium demand in the United States and Canada (shipments by domestic producers plus imports) totalled an estimated 6.1 million pounds in the first quarter compared to 6.5 million in the first quarter of 2022.

- Aluminium foil and electrical wire & cable saw increased year-over-year demand growth in the first quarter, 3.8% and 7.9%, respectively.

- In total, semi-fabricated – or “mill” – product demand was off 7.3% year-over-year through the first quarter.

- Aluminium exports (excluding scrap) to foreign countries increased 18.5% in the quarter.

- At 106.98, the association’s Index of Net New Orders of Aluminium Mill Products (baseline index of 100) has shown a decline of 8.2% year-to-date.

- Imported aluminium and aluminium products into North America (US and Canada) have fallen by 24.2% year-over-year in the quarter after growing 26.8% in 2022.

The Aluminium Situation report is one of more than two-dozen ongoing industry statistical reports developed exclusively by the Aluminum Association through surveys of aluminium producers, fabricators and recyclers. Subscribers to the Aluminum Association statistical reports have access to an online portal with data users can manipulate directly to produce interactive, presentation-ready charts and graphs.